Warren Buffett to federal government: stop me before I pay low taxes again!

Right off, I noticed a few things about Warren Buffett’s plea in the NY Times asking the federal government to stop coddling him and his fellow rich people and to please, please, PLEASE raise their taxes on income, capital gains, and dividends.

The first is that Buffett defines “rich” as beginning at an income of $1 million and then stepping up to a second (and even more taxable) category at an income of $10 million. He writes that in 2009 there were 236,883 households of the former type and 8,274 of the latter. Because Buffett is vague about exactly how much he thinks the taxes of the rich should be raised, we have no way of knowing how much this would increase government revenues (even supposing that he is correct about these people not changing their behavior accordingly in order to reduce their taxes). But doing my own admittedly crude math estimates, I can’t see how this would make much of a dent in the debt overall. It may be mostly window-dressing, even in the best-case scenario that Buffett assumes.

This is what Buffett has to say about how the rich will behave when their taxes are raised:

I have worked with investors for 60 years and I have yet to see anyone ”” not even when capital gains rates were 39.9 percent in 1976-77 ”” shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off. And to those who argue that higher rates hurt job creation, I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then: lower tax rates and far lower job creation.

I’m sure Buffett knows a lot more rich people than I do. But still, it’s silly to rely on anecdotal evidence, and I would guess that Buffett knows this full well. “Some of my best friends…” has never been the strongest of arguments. What evidence we do have is that tax increases are offset to a certain degree by tax-avoidant behavior of the rich, as least at the state level. On the federal level, it’s less clear what happens, and although I could spend the next twenty hours further researching the two sides of the argument, I’ll just link instead to this article, which gives a fairly even even-handed picture of what each side says about the possible effects of raising taxes on the rich, both pro and con. Short answer: we don’t really know, and experts differ greatly, but it may well be that whatever effect we would get would be relatively small either way.

Another thing that struck me about Buffett’s statement is the obvious: if the rich are so eager to contribute what they think is their fair share towards reducing the debt, what stops them right now from donating more to the government than they are already compelled to fork over? Buffett, like many rich people, does donate a great deal of money voluntarily—but to non-governmental foundations, both his own and others. He writes:

I know well many of the mega-rich and, by and large, they are very decent people. They love America and appreciate the opportunity this country has given them. Many have joined the Giving Pledge, promising to give most of their wealth to philanthropy. Most wouldn’t mind being told to pay more in taxes as well, particularly when so many of their fellow citizens are truly suffering.

Then why doesn’t he? Is someone stopping him and the rest? Somehow, I haven’t heard of Buffett or the other mega-rich giving more than what is required in taxes, although I suppose I might have missed something, since these are not the circles in which I run. But the prevalence and popularity of these private foundations seems to indicate the rich would much prefer to control their own money even when they give it away, and that they don’t trust the government to do what’s right by the money. And the existence and vigorous use of tax loopholes by the rich also seem to argue against Buffett’s notion that the rich would dearly love to give the federal government more of their money.

By the way, Buffett’s arguments could just as easily be used to pump for the Ryan plan, although that’s certainly not Buffett’s intent. But here’s how Ryan stated his own point of view back in April of 2011:

We’re saying keep tax rates where they are right now and get rid of all those loopholes and deductions — which, by the way, are mostly enjoyed by wealthy people — so you can lower tax rates. A simpler, flatter, fair tax code more internationally competitive so we can create jobs: That’s what we’re proposing. This isn’t tax cuts.

That’s a Republican talking, by the way.

Buffett also sneaks a little sentence into his op-ed that you might miss if you happen to blink [emphasis mine]:

Job one for the 12 [on the Congressional committee] is to pare down some future promises that even a rich America can’t fulfill. Big money must be saved here. The 12 should then turn to the issue of revenues.

So, just as Republicans say, the first thing to do is cut spending, including (perhaps) entitlements?

[NOTE: I want to point out (hat tip: Althouse) that this is the illustration for Buffett’s op-ed:

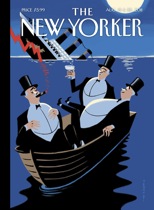

Plus, there’s the cover of this week’s New Yorker:

Once again, neo-neocon—right on the cutting edge. It’s Mr. Monopoly all over again!]

[ADDENDUM: for some more technical critiques of Buffet, see this and this (hat tip: Instapundit).]

A centrist type of person sent me something on this earlier today; this was my response:

—

“Buffett said he knows many of the mega-rich well, and most wouldn’t mind paying more in taxes, . . . . ”

They all are free to send checks in an amount of their choosing to the U.S.Treasury, are they not?

I carry no brief for the mega-rich, but I don’t think our present mess can be solved this way. When you do the math, they’re not our overriding problem.

Sure, go ahead and tax them more heavily; frankly, I don’t particularly care. Okay by me! But I do recognize that taxing them more heavily does not enrich us one iota, nor does it enrich our children.

(But I will note that the mega-rich may not be as willing to buy more of their probably unnecessary and frivolous goods, which in turn just may may provide needed employment for makers and servicers of those probably unnecessary and frivolous goods.)

As Victor Davis Hanson writes regarding the Obamas and Obama-sympathizers (such as Buffet) of the world, “On Monday swear that corporate jets blew up the budget, on Tuesday feel free to host corporate jet fly-in donors who pay $50,000 to hear you rail about the pernicious culture of corporate jets.”

—

I see Pat Buchanan chimed in as well:

PAT BUCHANAN: “No, I’m writing a note to Warren Buffett. But look, I’m a little fed up with these people who come on, you know, their big op-eds, all these admonitions. Why doesn’t he set an example and send a check for $5 billion to the federal government? He’s got about $40 billion. You know, you had a plan up there, I talked to Howie Carr at Boston where the super-rich could contribute an extra amount. It was something like one-tenth of one percent did it. You get all this noise from these big rich folks. Let them send checks and set an example instead of writing op-eds.”

Buffett doesn’t have much of income. Why would he pay himself just to get taxed again when Burkeshire Hathaway already pay corporate tax?

As to being on the cutting edge:

Spoon boy: Do not try and bend the spoon. That’s impossible. Instead only try to realize the truth.

Neo: What truth?

Spoon boy: There is no spoon.

Neo: There is no spoon?

Spoon boy: Then you’ll see that it is not the spoon that bends, it is only yourself.

IIRC I remember out that some donations to some charities are now tax-deductible.

So Good Ole Warren is just blowing smokes, folks…

And he can also afford a set of tax/lawyers-accountants to minimize, if not make go away, his legal income taxes.

Warren Buffett, Boy Hypocrite…

Explanation of the Spoon Boy/Neo exchange:

Spoon boy equals false messiah equals NY Times especially in equating consciousness with reality.

There is no such thing as an original progressive.

Curtis: By “cutting edge” I was not talking about the content of any of these articles, or of my post. I’m talking only about the graphics—I used Monopoly Man before I saw the others. An image whose time had come—even though it’s archaic, from the 30s and even earlier.

I grossly misrepresented my objection. I whiffed a sense of deference to the NY Times and would have you represent, to the fullest extent possible, it is bloggers like you who set the cutting edge.

Curtis: I can assure you that I have no deference, not even a whiff, to the NY Times.

To continue the stream of evidence we were accumulating during the previous thread, here’s a very good summary of various studies (with links) by Greg Mankiw, published, alas, in the NYT:

http://www.nytimes.com/2009/12/13/business/economy/13view.html?adxnnl=1&adxnnlx=1313434660-G+Yus/CHKUEvcRGQAGQUjA

And Mankiw doesn’t even mention Prescott.

Buffet, of course, hasn’t a clue, and really doesn’t care.

What a weird man. He obviously has a hangup about never getting mugged. Probably goes all the way back to nobody would steal his bike as a kid even if he left it in the driveway overnight.

And here’s the latest news from (my current state of residence, unfortunately) California:

http://www.gormogons.com/2011/08/pure-genius.html

There are no words for such stupidity.

kolnai: for those who don’t have a NY Times subscription, here’s a link to a PDF version of the article:

http://www.economics.harvard.edu/files/faculty/40_Tax%20Cuts%20Might.pdf

Buffett’s main economic strategy is to arb the estate taxes for highly successful, illiquid family firms: See’s Candies, Blue Chip Stamps, Dexter Shoes, etc.

Zero estate taxes, last year, destroyed his gambit.

His insurance companies are perfect tax shields. He gets to decide how much income Geico will report.

His income is almost entirely capital gains. He has to keep selling BH shares lest he cross over into the Personal Holding Company zone.

So his request for higher taxes on the rich is entirely one of self interest. He, himself, won’t be paying these higher taxes.

You will.

blert: I guess “the rich” is always someone else.

Even when you’re Warren Buffett.

Another thing about Buffett: He observes that his 20-some employees pay much higher tax rates than he does. It would be possible for the estimable Warren, their capo, to re-do their compensation agreements so they could bask in his lower rate, I am sure.

1st off — I agree (marginally) that one who is employed as a hedge fund manager should pay “ income tax” rather than have his income taxed at the lower capital gains rates. Sort it out however, but that loophole should be closed. Of course, if there was a 15% flat tax, equal to the capital gains tax, then ignore my 1st statement — it should be fair across the board.

As for Warren — what a hack. Is there any doubt that Warren circa 1975, trying to make his fortune, was anti-tax? Now that he is almost literally the richest man in the world he spouts off this ANTI-CAPITALISTIC jargon. Money taken by the government is wasted. Warren, why not allow the federal government to nationalize all of your businesses if you feel they can do a better job with your money? This is a man who made his fortune exploiting family held businesses that would be otherwise forced to sell in order to pay the estate tax after the parents died. Warren came in and “cut a deal” that gave him an exploitive share of the business in lieu of selling it off to pay the estate tax liability. Just pull the ladder up for the rest of us, you made your fortune. Let me guess, money doesn’t make you any happier and Warren doesn’t think we need to figure this out for ourselves.

I’m amazed that so many obvious problems could escape an intellect like Buffet’s — such as the wide gulf of principle between volunteering one’s own wealth and volunteering others’ (and its grave implications for a society that aspires to be free), or the mathematical futility of trying to make a dent in our debt and unsustainable spending problems by simply Taxing the Rich. He acknowledges, yet seems overly dismissive of, the potential for unintended consequences on investor behavior that seem always to result from such measures. People will continue to put their money somewhere in hostile times, but where they choose to move it, based on the behavior our tax code punishes or rewards, is going to have ripple effects on the economy.

Good Ole CHarlie,

It’s more than just the donations to charities that you cite. If Buffet felt so much angst at paying so little in taxes why oh why did he announce several years ago that he will be donating most of his wealth to the Bill and Melinda Gates Foundation (a TAX FREE transaction)? Surely he could have arranged some taxable transactions so that the govt could take its “pound of flesh” from his assets!

Secondly, most people don’t realize that many of his company’s holdings (Berkshire-Hathaway) are the stocks of insurance companies. Among the upper middle class and upper economic classes life insurance is used to transfer wealth from one generation to the next. Life insurance proceeds are income tax free (federal and state) and in most states inheritance tax free as well.

Furthermore, policies used in this manner are oftentimes life insurance policies with a death benefit of many hundreds of thousands of dollars; in other words, real money makers for the insurance companies whose stock Berkshire-Hathaway holds. The lower the tax rates, the less efficient it is to do this because at some point it’s cheaper to pay the tax than purchase the insurance.

Calling Buffet a hypocrite is being charitable.

On Warren and Baraq: Ignore what they say, watch what they do. Nothing either says in public is to be given any credence whatsoever. Period.

Buffet is in the insurance business.

Estate tax planning includes huge amounts of life insurance.

Agents who sell in the estate market talk about the miserable, confiscatory, punitive estate tax. But when it comes time to reduce it or eliminate it, it’s wait a minute, we need the tax revenue….

Don Carlos,

“. . .watch what they do.”

Absolutely. As you say, nothing else matters.

neo – that American Thinker article is devastating and hilarious (the way it’s written I mean, not the substance). The closing line is perfect deadpan. Loved it.

Re: Chantgrill’s American Thinker article.

Chantrill is incorrect when he states that life insurance is not considered part of your estate. Anything you own is part of your estate; to get a life insurance out of the estate it can not be owned by you.

As for Dick Patten’s commentary about buying businesses distressed by the estate tax, he is absolutely correct. Not only must these businesses be sold to raise quick cash to pay the IRS, but oftentimes there is no one in the family who can continue to run them or who understands the value of the business itself. So if you have mom and dad’s business worth $50 million but you have no idea what it’s worth, and along comes Mr. Buffet and his best offer is $30 million, this still gives you enough to pay the IRS and have $2.5 million left over—-what a deal!!

When saying the “you have no idea what it’s worth,” I should have specified that I was speaking of future growth potential (what it will be worth). At the business owner’s death the heirs would know the business’ value because it would have to be assessed in order to determine the tax due to the IRS.

jeff,

Lots of the tax money collected by the gov’t is not simply wasted: it supports dysfunctional activities like encouraging out-of-wedlock births and coming up with new regulations that hurt business. If the money were simply flushed down one of the new-fangled toilets mentioned above, we’d be better off much of the time.

T – oops, never mind then. Guess it wasn’t so devastating. I know you know whereof you speak on these matters.

The closing line of his article was still funny though 🙂

Buffett has a habit of “talking his book”.He loathes competition, notably from the private equity field, hence he wants to see the carried interest tax raised to reduce the incentives for that industry.He’s a grubby rent seeker who has long had a cozy relationship to DC power brokers while playing his schtick as the rube from Omaha.

1. A shout-out to J.J. formerly Jimmy J. for pointing out the immorality in our economy.

2. I haven’t closely read all 100 comments in this thread and its predecessor, so apologies if I’m repeating somebody’s idea:

If tax rates on the rich are very high, the way for the government to maximize revenue is to maximize the rich’s share of the country’s annual private-sector income. The government concentrates as much income as possible in the highest bracket; taxes it; and redistributes it. While broadcasting populist babble about socking it to the rich, the politicians practice crony capitalism to keep wealth concentrated. The rich get economic security and political backing; overall, they might be better off than they would be in a more open economy. The politicians get taxes.

Maybe this is what champion rent-seeker Warren Buffett is up to.

Kolnai,

No, it was still devastating. Chantrill was in essence correct; his error was one of technical detail. Insurance IS used to pay estate taxes and when one is in that economic bracket the policies are usually quite large, quite expensive and quite profitable for the insurance company.

It’s just that insurance is not exempt from estate tax per se. If you own the insurance yourself it is part of your estate and it, too, is subject to estate tax, but there are techniques which are routinely used to innoculate it from that tax. And, the death benefit is STILL federal and state income tax exempt.

Ref life insurance and estates: It is taken for granted that any life insurance involved in estate planning will not be owned by the insured whose estate is being planned.

See Crummey trust, and said powers where you can have it and not have it.

The books are full of court cases, some bearing the names of those unfortunate enough to win them, and even more unfortunate to lose them, in which the unfortunates are trying to find the right combination of owning something and not owning something–you don’t want to lose control, but control is a part of ownership–in order to retain some control and yet not be an owner.

Teddy Roosevelt promoted estate taxes for three reasons; revenue, turnover among the very rich, and envy–appealing to the voters’ envy, that is.

It has been said, with no way of verifying it, that attempts to avoid estate taxes, cost the economy so much in productivity that the estate tax revenue raised from the remaining is less than would be raised from income and capital gains taxes if the economy were not so restricted. Can’t say, but the expenses involved in my clients’ planning are not inconsequential, and they amount to money that could be better spent elsewhere.

If it isn’t a wash, it is getting there.

Estate taxes actually cement the upper-upper crust. Rising bazillionaires are hampered far more than are those who’ve already accumulated huge amounts. For example, if you own $50 million, a 5% return on the money is $2.5 million. You literally cannot spend $2.5 million and have nothing to show for it. Sort of the Brewster’s Millions concept. You can buy a two million dollar house, but you have converted money to real estate, not spent it. If you actually manage to put 1% into the shredder, the rest, 4%, remains on the table. That means the principal, $50 million, doubles in eighteen years, again in the next eighteen years, etc. In the meantime, your ability to shred 1% of $100 mill is pretty lame, so the return on the principal is likely to be, say 4.7% that year, or 4.85% a few years later. So the first double is in, say, sixteen years, the next in fifteen years, the next in twelve.

So, you inherit $50 mill at age sixty-five. By the time you’re eighty-one, it’s $100 mill, and by the time you or your spouse, whichever is later, pass, it’s close to $200mill.

Uncle Sugar takes half. That leaves $100 mill divided between three kids who have their own stuff and so between the two are already ahead of where you were when you got the original grubstake of $50 mill. If it’s only two kids, it’s $50 mill plus their own stuff.

In the meantime, somebody who leaves $5 mill will have, under current plans iirc, $1mill not estate taxable, and the balance at close to 50%. So, say he leaves three mill between three kids. They have their own stuff, but it’s not much compared to the former case, and more of the return on the principal is spent rather than saved or merely converted which does not reduce the principal as with the former case. Thus, the rate of growth might be, say 2%, meaning no doubling until well after thirty years.

So, it cements rather than refreshes the uppermost of the wealthy.

That leaves envy. Which seems to be doing quite nicely.

Richard Aubrey wrote:

“It is taken for granted that any life insurance involved in estate planning will not be owned by the insured whose estate is being planned.”

I repeat that Chantrill was incorrect in saying that life insurance is not subject to estate tax. It IS. Period. Action must be taken to innoculate it from estate tax. Respectfully, a good estate planner takes nothing for granted when s/he does, those are the cases that are lost in tax court.

Richard Aubrey,

To carry your growing estate scenario one step further, I find it amazing that no one questions families like the Kennedys. Here we have a family that routinely agitates for higher taxes (JFK excepted), but no one ever asks this question: “When the top estate tax is 55% how have the Kennedys been able to pass down wealth through 3 generations virtually intact?”

As you and I know, they promote higher taxes from which they can innoculate their own money. The great liberal secret: Taxes for thee, not for me!

gs, Thanks for the recognition.

A good post and many fine comments. There really isn’t much to add except to reiterate the article by Greg Mankiw where he cites studies showing the stimulative effects of reduced taxes vice increased government spending and debt.

We do have the example of Japan staring us in the face. They have tried to spend their way out of a deflationary crisis and it hasn’t worked. It is said that Japan can handle more debt than we because it is mostly owned by its citizens. However, many have missed the fact that one reason Japan has not recovered is their only wealth creating resources are their hard work, creative manufacturing, and ability to sell manufactures to the world. They have no natural resources that they can use to create new wealth. In addition, they have been overtaken by China in the manufacturing and marketing of goods to the world.

We have resources that we can exploit to create new wealth. However, our environmental whackos have, since the establishment of the EPA, slowly put them off limits to development. That is one way to work out of a deflationary crisis – use natural resources to create real new wealth.

Back to raising taxes. I am opposed to increasing taxes because, as pointed out by Mankiw, it does not stimulate business. I’m also opposed because our history shows that Congress has never cut spending when income has increased. NEVER!!

Tax reform? All for it. If simpler, lower taxes are enacted there will be an increase in revenue. The question then becomes, how do we stop Congress from spending it?

JJ formerly Jimmy J,

You mention the importance of natural resources and IMO you are correct. The single act with the most wide-ranging and immediate impact that the president could do is expand domestic oil exploration and production. The results:

1) it would immediately create high paying blue-collar jobs to dent the “mancession;”

2) these jobs would create taxable salaries to the workers;

3) his production would also create taxable profits to the service industries (pipe suppliers, food service suppliers, etc.);

4) the mere threat of future oil production would drive current oil/gasoline prices down. Why? Because OPEC knows that certain types of oil exploration/prioduction require a minimum price of oil to be profitable. Domestic action would push OPEC prices down as they try to make our domestic production unprofitable;

5) it would create pressure to reduce the prices of all things delivered with fossil fuels (plane, train, truck fuel) which is just about everything;

6) driving down gasoline prices and everything delivered with gas/diesel would put more $$ into consumers pocket and allow then to purchase other things;

7) reducing OPEC prices and eventually bringing domestic production on-line, would reduce the flow of U.S. $$ to unfriendly regimes.

There is no downside here, but Obama is dedicated to “going green” and, by his own admission, he looks to raise gasoline prices and bankrupt coal companies.

No “hope” for now until the “change” of the 2012 elections.

In a strange way, environmentalist have saved us. There are so many resources that we can tap – and at once – that a massive increase in jobs and GDP are almost certain.

When Buffet sells off ALL he has, and depends on life from the kindness of strangers, then I will believe in him. I’m pretty sure Jesus spoke of this – not that wealth is wrong – but a responsibility.

T,

I couldn’t have said it better. Spot on!

Bobar,

One might also argu that if we had been tapping these resources all along, this recession would have never happened in the first place.

Everyone knows left-wing government builds jobs and wealth, not investors; Buffet now joined at the hip with Soros, pathetic…

Germany has an intersting twist in its estate tax laws. Heirs of small businesses, often specialized manufacturing companies, do not pay estate taxe if they keep the business up and running for 10 years. At least that has been the policy; it may have been tweaked or modified.

The advantage is that the company stays open, the heirs tend to study engineering instead of going to law school, and the bond with the local community remains. It cuts down on corporate takeovers.

All our problems would be solved if we just taxed the rich more. What do I mean when I say the “rich.” Who ARE “the rich.”?

Why, that’s quite easy to define and thank you for asking.

The rich are anybody that makes roughly 33% more than I happen to be making at the time.

So if I am making $75,000, then anybody making over $100,000 doesn’t “need” lowe taxes and “can afford” to pay more of “their fair share.” I mean, you’ve got it made and shouldn’t complain if you are in six figures, so just shut up and pay up. Says I.

But then….hmm, if I am now making $100,000 – well you know, once you get up into the 140’s or 150’s, you really can afford to pay a little more of your fair share for the common good. You are making more than you need and can as our president once said, spread it around. But right at the 100K level….taxes should certainly not go up!

Oh wait. If my wife and my combined income is $160…….well then, obviously the rich are those up there above the $200-250 level… Not where WE are. WE’RE not the ones who should be taxed more; the RICH are the ones who should pay more.

See. The formula is quite simply and easy to apply. I have it all figured out.

Glad to provide this public service.

T. Life insurance is clearly and unambiguously out of the estate of the insured if somebody else owns the policy. You really can take that for granted. Simple. It’s the attempts to keep some part of control that causes the difficulties.

A classic example is a guy who had a Crummey trust and was sending it money. The trust’s major function was to pay for the insurance yet keep it out of his estate. The check was in the amount of the premium and on the memo section he had written “life insurance”. Bingo. Sucked that puppy back into his estate.

The Orifice of Omaha.

I, stupidly, served my country and worked in defense industries, suffering the lay-offs. I will never be able to afford a share of B-H, and now he wants into my wallet? Stop or I’ll shoot.

Richard Aubrey,

I think we are speaking past each other. Of course life insurance is out of your estate if you don’t own it. I never questioned that.

Specifically Chantrill wrote that,” . . . when you die, your life insurance payout doesn’t count as part of your estate.” My point was that he implied that life insurance is exempt from estate tax because it is life insurance. As you know, this implication is incorrect. He should have written that “your life insurance doesn’t count as part of your estate if you don’t own it.”

You can speak all you want about what is “taken for granted,” or what is “expected,” but life insurance isn’t immune from federal estate tax because it is life insurance.

This is an inaccurate statement; life insurance is exempt from INCOME tax and many states’ INHERITANCE tax but NOT from federal estate tax.

T.

Correct.

There is, or used to be, a section of estate tax law which would allow a farm to be valued for estate tax purposes as a farm as long as it was worked as a farm for, I think, ten years. If it isn’t worked as a farm, it is valued for estate tax purposes as if it’s worth as much as the land was for the subdivision next door, usually, or until recently, considerably more.

If this is still valid, there is a possiblity of a retrospective estate tax hit years later.